Transfer of Equity Hidden heading

During the last few months we have had many Clients asking: “I want to transfer my Property into someone else’s name, does that mean I need to sell the Property?” The answer is “no”, a simple transfer of equity will suffice.

Here’s an example. Mike’s mother wants to transfer the property into Mike’s name. Instead of selling the Property to Mike, the relevant documentation is completed by the instructed Solicitor transferring the property and is then registered at the Land Registry. It is as simple as that!

Where there is no money being transferred between the parties, you will have the opportunity to instruct one solicitor, who will be able to complete the transfer document and register this at the Land Registry. Additionally, there will be no Stamp Duty Land Tax liability for such a transfer. These cases usually occur between parties who are related by blood or marriage. For example, a transfer of equity between husband and wife as part of a divorce settlement.

If there is a mortgage (legal charge) secured on the property it is slightly more complicated. The first requirement will be that before any transfer is completed the lender’s consent to the transfer must be obtained. Consent will usually be given where the new owner can prove that they have a steady financial background, and can undertake to pay any mortgage payments. However, there may be times where the lender would require for the mortgage to be paid in full before the transfer can take place.

This article is written on [12th August 2019] by Dominic Coleman who is a trainee solicitor specialising in Property Law.

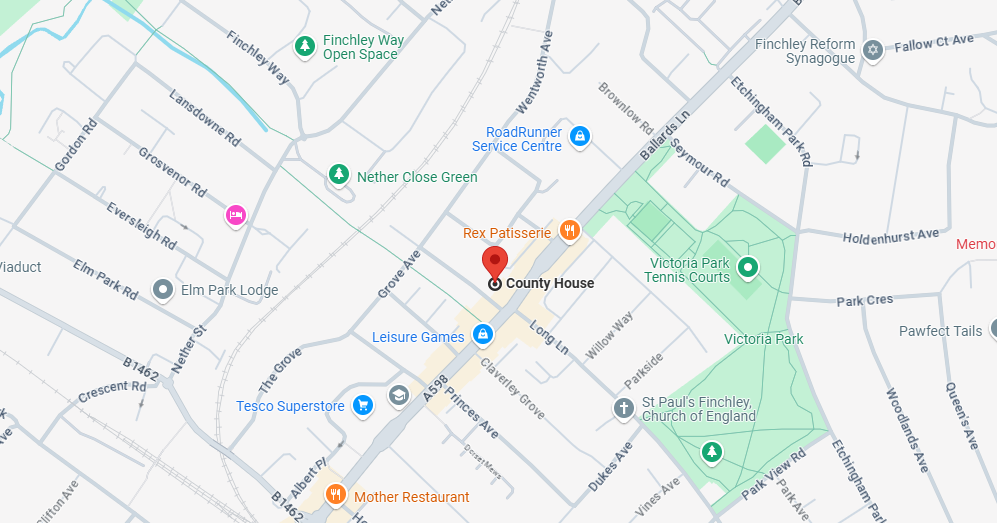

Lester Dominic Solicitors

Upper Floors

85-87 Ballards Lane

Finchley Central

London N3 1XT

Tel: +44 (0)20 8371 7400

Email: enquiries@lesterdominic.com

This article was written by Dominic Coleman, who is a trainee solicitor specialising in Property Law.